The purpose of every trader be it intraday, swing or positional is to make profit, consistently, over a long period of time. If a trader is able to do so for a year he can call himself a successful trader. However, most of the traders find it hard to make consistent profits due to numerous reasons ranging from lack of discipline to greed.

Whosoever has done trading in any segment be it equity, commodity, futures or options must be well aware of the fact that making money through trading is Not Easy. With instant availability of vast amounts of news and numerous technical indicators such as ichimoku clouds, bollinger bands, RSI, or pivot points for that matter, one can easily get overwhelmed and end up making a wrong decisions while trading.

There doesn’t exist any one magical technical indicator which can give 100% accuracy in every trade, for, if there were one, stock market traders would have been the richest people on the planet. But we Do have successful traders although they may be less in number but they surely are rich as well as successful. So what is it that these few successful traders are doing which most of the other not-so-successful traders are Not doing!!

As per my personal experience one common thing among every successful trader is that each of them have simplified their process of trading. They enter a fixed number of trades usually less than or equal to three and use a fixed number of technical indicators which is only one in most cases. Today, I will cover one such tried and tested technical indicator which is capable of giving you profitable trading signals, provided you use it properly, that too, only when market conditions are suitable.

Ichimoku Cloud: A Complete System in itself

It is none other than the Ichimoku Kinko Hyo technical indicator commonly referred to as Ichimoku Cloud or just Cloud Charts. It was developed by a Japanese journalist named Goichi Hosoda in the late 1930s, who used to be known as Ichimoku Sanjin which means

“What a man in the mountain sees”

He spent 30 years perfecting the ichimoku indicator before releasing his findings to the general public in the late 1960s.

No wonder all the hard work of Mr Goichi Hosoda was totally worth it. As the final outcome is a technical indicator which is reliable and shows the complete picture of the stock in question to the trader, at One glance. The Ichimoku trading system constitutes 2 moving averages and 3 spans. A total of 5 components makes ichimoku look quite complex at the first glance however trust me it is not the case.

Without further adieu let me break down its complex looking structure so that you are able to detect ichimoku cloud signals in order to earn profit regularly while trading. You can add it to your chart by searching “ichimoku” under the indicators just like you search any other technical indicator. Most of the popular charting websites like investing.com and tradingview.com do have ichimoku in the list of indicators they support.

If you are using the web version of kite, a trading platform provided by Zerodha, just press the studies button located at the top of the chart, search for ichimoku and click on it from the search results. If you are using Binance (an exchange to trade in Cryptocurrencies like bitcoin, ethereum etc.) hover your cursor on icons on top of the chart, the one we are looking for will read “Technical indicators”. Press it and search for ichimoku just like you did in other trading platforms.

By the way if you are yet to open a trading account with Zerodha or Binance you can do so using these links:-

Binance: https://tinyurl.com/y4bhds5m

Zerodha: https://tinyurl.com/y4d8tebl

As far as ichimoku cloud settings are concerned just keep the default settings. You may change the colours though as per your preference. So once you have successfully added it you are all set to learn how to use the ichimoku cloud trading strategy.

Five Components of Ichimoku Cloud Indicator

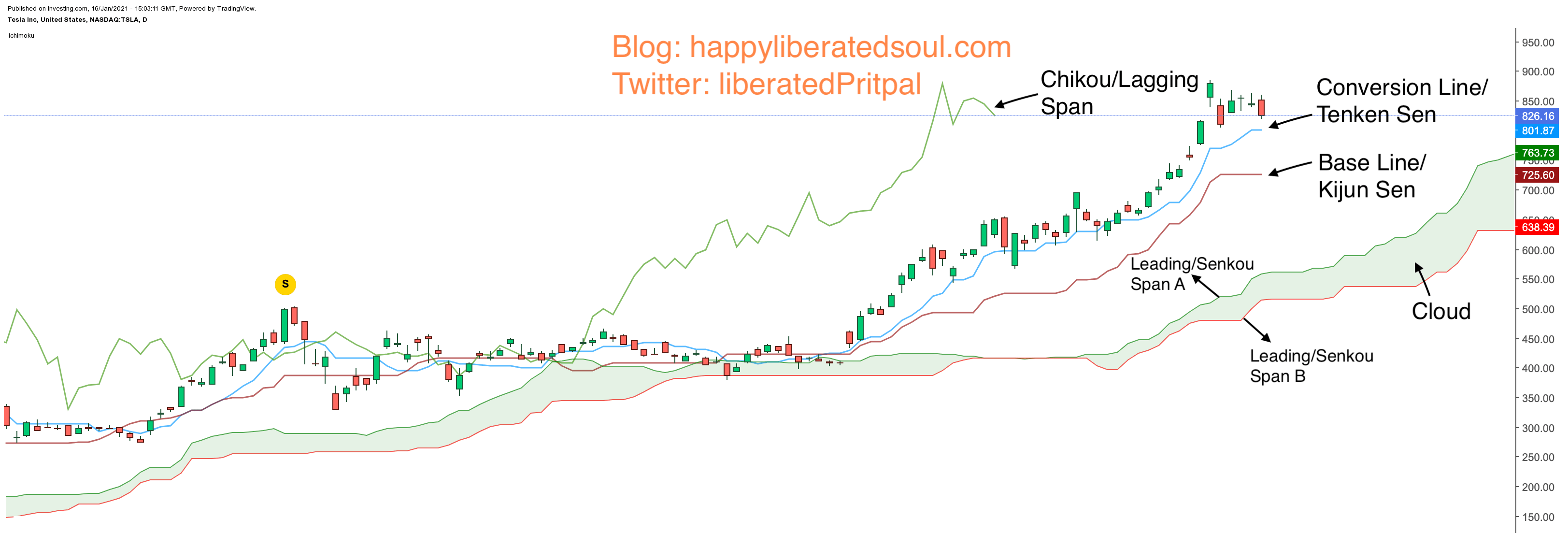

I’ll begin by explaining each of the 5 components of ichimoku indicator with the help of a Tesla’s chart on a daily timeframe. Before reading ahead please be informed that to facilitate better understanding I have used 8 different charts in this ichimoku guide. So while learning to read to open any chart in large mode you can click on the chart and click browser’s back button to come back to the article:

Tenkan Sen or Conversion Line:

The blue line in the chart is nothing but 9 days moving average. It is also known as Tenkan Sen as marked with a black arrow in below Tesla’s chart. It is the fastest moving line in ichimoku setup and gives indication about short term direction of trend of the stock in question.

Kijun Sen or Base Line:

The brown line (red if you are using Zerodha’s Kite) in the chart 26 days moving average. It is also known as kijun sen or simply kijun line as marked with a black arrow in below Tesla’s chart. It gives some idea about the medium term trend for the stock in question.

Senkou or Leading Span A:

The green line acting as one of the boundaries of the cloud in the chart is calculated by adding tanken sen and kijun sen and dividing the sum by 2. The resultant line is then plotted 26 candles ahead of the closing of the current candle. It is also known as Senkou Span A as marked with a black arrow in below Tesla’s chart.

Senkou or Leading Span B:

The bright red line acting as the other boundary of the cloud in the chart is calculated by finding the highest price point in the last 52 candles, adding it to the lowest price point in the last 52 candles and dividing the sum by 2. This is also plotted 26 candles ahead of the closing of the current candle. It is imaginatively called Senkou Span B as marked with a black arrow in above Tesla’s chart.

Kumo or Cloud

The Leading Span A and Leading Span B together form the Cloud by each acting as one of the boundaries of the cloud. It can be green or red in color. Cloud is also referred to as Kumo, which in Japanese means cloud. The real power of Cloud lies in fact that it’s drawn 26 candles ahead of current candle which enables traders to predict future price with confidence and gives them the much needed edge in the stock market.

Chikou or Lagging Span:

The dark green line is nothing but the closing price of the current candle plotted 26 candles behind the current candle. It is also known as Chikou Span as marked with a black arrow in above Tesla’s chart.

For trouble free technical analysis you will be needing some fast and reliable charting platform like TradingView. You can get their basic and professional according to your requirement and receive $15 bonus using below links:

Now that you know “what is what” of ichimoku cloud indicators I’ll explain to you some tried and tested ichimoku cloud strategies which will help you in identifying profitable trades. But before that let me share with you some important aspects of ichimoku cloud trading which are often ignored or forgotten by the traders resulting in incurring losses by entering a trade at a wrong time.

When NOT to Trade using Ichimoku Cloud Indicator?

As the heading suggests here I am going to cover when not to enter a trade using ichimoku. Every mentor or trading guru for that matter tells you when to enter a trade using signals given by various technical indicators. However, none of the trading coaches or mentors tells you when Not to trade, thereby saving your hard earned money. Here I am going to tell you exactly what other trading mentors are not telling (or are rarely telling).

One important element of ichimoku is that it does not work on all timeframes. Even if it does, the probability of getting a profitable trade reduces significantly.

The other equally important aspect is that it does Not work in all market conditions. If the stock is trading in range-bound or sideways mode, ichimoku is Not going to work. A stock is said to be in range-bound when its price keeps bouncing between a specific high point i.e. resistance and specific low point i.e. support for a significant amount of time. I will explain how to identify that a stock is in range-bound mode using ichimoku indicator with the help of a chart later in this article.

Thus, if either of the above 2 points holds true for the stock or index you want to trade using ichimoku indicator then it means you are doing nothing but making a recipe for disaster because it is not going to work.

So when does Ichimoku Clouds Indicator works?

Now that you know that when not to trade using ichimoku the next obvious question is when to trade using ichimoku kinko hyo? Yes there are 2 important preconditions for using ichimoku indicator to trade:

#1 Stock should be in a clear Trend

Stock you want to trade using ichimoku should be in a clear trend. It can be either uptrend or downtrend. Some of you might be wondering how to identify if a stock is in uptrend or downtrend. This is where the power of ichimoku charts comes into picture. Thanks to the comprehensive nature of ichimoku clouds it lets a trader easily identify if the stock is uptrend or downtrend. To add to it, ichimoku also lets you identify if the market is trading sideways.

How to identify Trend using Ichimoku Cloud Indicator?

Lets quickly understand how to identify the trend using ichimoku clouds indicator with a help of a Bitcoin chart:

In the below BTC/USD chart, on a 1 day timeframe, after a series of higher highs and higher lows, the CPM (current market price) of bitcoin is trading well above the cloud which indicates that bitcoin is in uptrend on daily timeframe. Moreover, the CPM is trading above the conversion line or tenkan sen as well, it went below it briefly for 3 days after 26th november but after that it has been above it.

As long as price continues to remain above the base line or kijun sen uptrend will remain intact. A close below baseline can signal a beginning of consolidation or a downtrend.

In the below chart of Reliance industries on a daily timeframe I have depicted a down trend from 17th July 2019 to 19th Sept 2019 i.e. till the end of orange rectangle. The CMP moved up in august however it failed to close above the cloud. After few days, price again closed below conversion line and the downtrend continued till the end of rectangle i.e 19th Sept. 2019

Thereafter the trend changed from Down to Up, thanks to a long solid green candle on 20th Sept. 2019 highlighted by the beginning of a light green rectangle. This green candle not only closed above the blue conversion line and the maron/brownish base line but also above the cloud. The very next candle was a solid but a relatively small red one however it found support at the Span B i.e. upper boundary of the cloud and closed above it. It was followed by an almost solid green candle of equal length which pretty much acted like confirmation of an uptrend.

This confirmation of an uptrend perhaps turned out to be the correct one and followed up with a series of higher highs and higher lows. Daily candle sticks closed above the blue conversion line for most days and above the maron base line for all days till the end of the light green rectangle.

So this is how you can identify if the market is in uptrend or downtrend using ichimoku cloud indicator alone and execute your ichimoku trading strategies accordingly.

How to Identify a range-bound market using ichimoku cloud?

In the below chart of NBCC (National Buildings Construction Corporation Ltd) on daily timeframe, price is constantly oscillating above and below both the conversion & base lines. Price also remains inside the cloud for a significant number of days. Both of the above factors indicate that NBCC is trading sideways.

Price closed below the base line in the beginning of October. However, it was not followed up by lower highs and lower lows which shows that stock is still trading sideways. After some candles price went above the conversion line as highlighted using rectangle with red shade. Price even went above the base line and entered inside the cloud. Thereafter price continued to trade inside the cloud.

In the beginning of November price crossed the upper boundary of the cloud but it failed to close above it as highlighted using a rectangle with a blue shade. Thereafter price remained stuck inside the cloud denoting that NBCC stock is still trading in range bound mode.

Eventually in December there was a long solid green candle that closed not only above the cloud but also above the conversion & base lines as highlighted by a rectangle with green shade. This could have been a beginning of an uptrend if only it was followed by few candles with higher high and higher lows. But that was not the case as the very next day the price formed a red candle again closing inside the cloud. Hence NBCC share price continues to trade sideways.

As per the rule learnt above, one should not trade in NBCC using ichimoku kinko hyo indicator as it is trading sideways.

Before going ahead let me share with you how I managed to get these priceless insights about ichimoku cloud technical indicator. Ichimoku was briefly introduced to me by one of the trainers in one of her sessions. That brief introduction was enough to trigger a keen interest in me to learn ichimoku clouds in detail.

Thankfully that trainer shared with me the name of few good books to learn about Ichimoku Clouds indicator, one of which was Ichimoku Charts: An introduction to Ichimoku Kinko Clouds by Nicole Elliot. The moment I got hold of this book I read it pretty fast, within two-three weeks. Just in case you would like to learn about how to use Ichimoku clouds in detail, Ichimoku Charts: An introduction to Ichimoku Kinko Clouds by Nicole Elliot is the best book to read for Ichimoku clouds indicator.

Nicole Elliot has beautifully covered all aspects about Ichimoku in this awesome book with a help of examples using charts from different market segments making it simple and suitable for a vast number of readers. Hence I highy recommend this book by Nicole Elliot to learn, trade and make money using ichimoku cloud technical indicator.

#2 Ichimoku works Only on a Longer Timeframe

Timeframe you are using should be 1 hour or more. Yes, the ichimoku cloud indicator works only on a longer timeframe. In other words,

“The longer the timeframe, the more reliable ichimoku trading signals will be”

As per my personal experience it works best with a 1 day timeframe for indexes like Nasdaq, Dow Jones, FTSE, Nikkei, Nifty, Shanghai and the stocks listed under them. This means that using ichimoku cloud for day trading might not be a smart decision at least if you are trading in the equity segment.

For segments, that have longer trading hours like currency, commodity and crypto currencies like bitcoin, ethereum etc, ichimoku indicator works great with a 4 hours timeframe as well. Thus for these segments you may use ichimoku cloud even for day trading provided you have gained enough experience in using ichimoku for swing and positional trades using a higher timeframe.

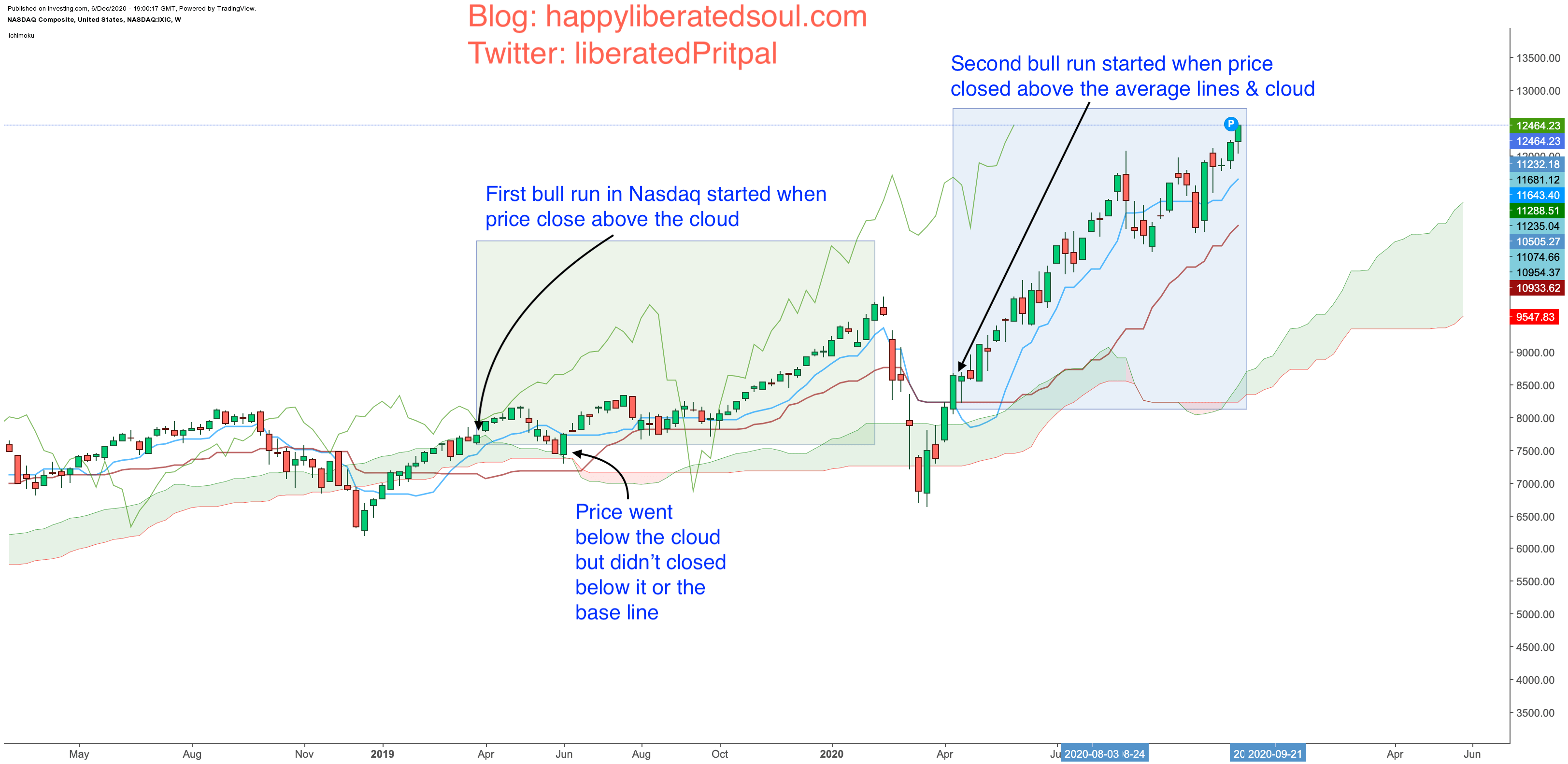

Talking about higher frames let me share with you a chart of the Nasdaq Composite Index to further demonstrate that ichimoku cloud indicator gives trading signals with higher probability of success when the timeframe is higher.

Below is a chart of the Nasdaq Composite Index on a weekly timeframe clearly depicting the two separate bull runs that were witnessed after March 2019. Both the uptrends can be easily detected with ichimoku signals on a chart with weekly timeframe. The first bull run started at the end of March 2019 as highlighted using a rectangle with green shade, when the weekly candle closed above the cloud at 7729. Although price went below it briefly in june but weekly candle never closed below the cloud or the baseline.

As a smart trader who was long on Nasdaq you should have booked some part of the position at 9500. As a conservative trader you should have exited the remaining position at 8567 when a long bearish weekly candle closed below the base line and subsequent weekly candle faced stiff rejection at the conversion line.

The second bull run started in April 2020 when a weekly candle closed above cloud as well as both average lines (base & conversion) at 8650 as highlighted using rectangle with blue shade in the chart. This was one hell of a bull run and that is continuing till present i.e. 7th december 2020 at a price of 12464. This goes to show that ichimoku is best indictor for positional trading. As a smart trader you should book some part of your long position at these levels.

The remaining part of the position can be exited (partially or fully) if price closes below the base line, not blindly though. One should of course take into account the shape of the candle, follow up candles, news and prevailing market conditions both in the United States as well as at global level.

Ichimoku Cloud Trading Strategies that Works

Now that you know exactly when ichimoku kinko hyo works and when it doesn’t work let me explain to you how to use ichimoku cloud strategy, which I have been using to make consistent profits while trading. In fact I use two ichimoku cloud strategies to enter and exit my swing and positional trades in equity, crypto and sometimes even commodity segments.

Cloud Breakout strategy of Ichimoku Clouds:

Breakout

When price candle closes above the upper boundary of the cloud it is called cloud breakout. It is also known as Kumo breakout strategy or ichimoku breakout strategy. Wait for the follow up candles before entering the long trade. If cloud breakout is followed by a couple of higher highs and higher lows candles or price gets strong support at the upper boundary of the cloud, it gives a confirmation about the breakout and saves you from false breakout. I’ll explain it with a help of a chart while combining this strategy with moving averages bullish crossover which is my next ichimoku kinko hyo strategy.

Breakdown

Just like breakout, cloud breakdown also works as a relevant ichimoku kinko hyo trading strategy. When price candle closes below the lower boundary of the cloud it is known to be a cloud breakdown. It is also known as Kumo breakdown strategy.

Wait for the follow up candles before entering the short trade. If cloud breakdown is followed by a couple of lower lows and lower high candles or price faces strong resistance at the lower boundary of the cloud, it gives a confirmation about the breakdown and saves you from false breakdown. I’ll explain it using a chart while combining this strategy with moving averages bearish crossover which is my next ichimoku cloud strategy.

Moving Averages Crossover Strategy of Ichimoku Clouds:

Bullish crossover strategy

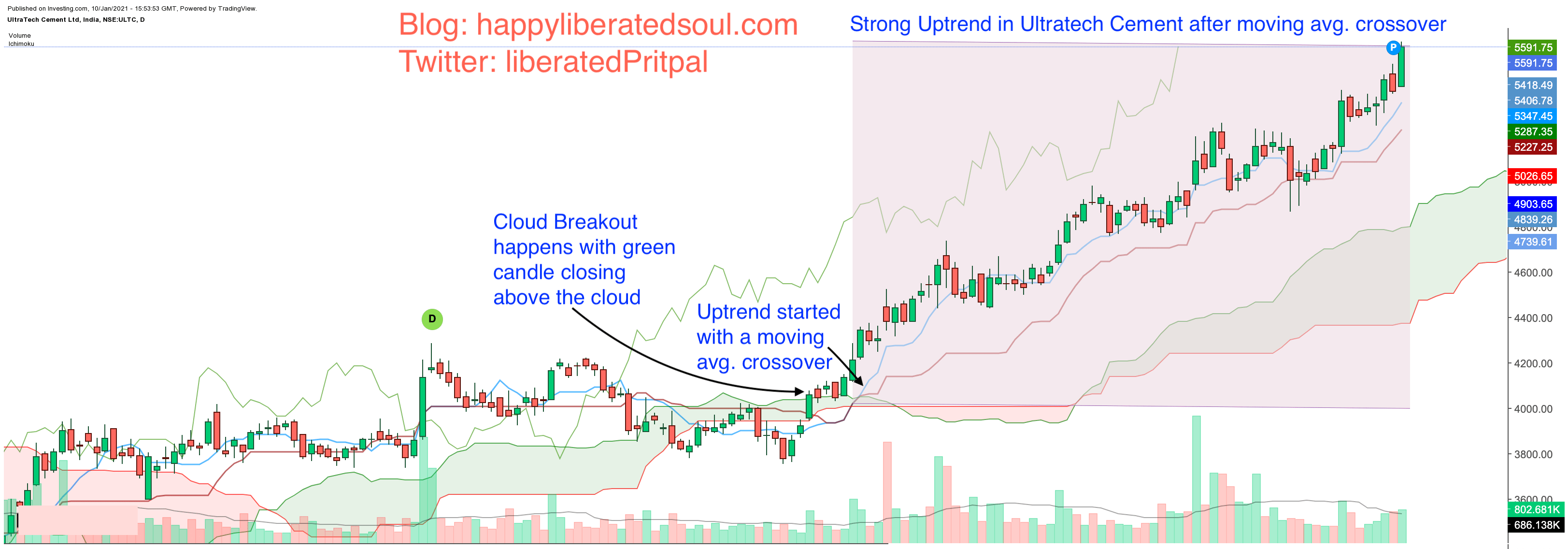

The conversion line i.e. tenkan sen crosses the base line i.e. kijun sen from down to up it is known as moving averages crossover or golden crossover. It is also known as the Tenkan-Kijun Sen cross strategy, TK cross strategy, bullish crossover strategy or simply Kijun cross strategy. In this case it indicates the beginning of an uptrend and gives a good opportunity to go long. For eg. look at a sharp moving averages crossover on the daily chart of Ultratech cement on 8th August 2020 as highlighted right at the beginning of the rectangle with pinkish shade.

It is important to note that stock had closed above the cloud just few days ago and was trading above the cloud so the cloud breakout strategy has already given a buy signal. If the price on the day of crossover were trading within or below the cloud I would have waited before entering my full position in such setup. I would have rather taken a partial position less than 50% of my full intended position that too if my risk reward (R&R) were optimal.

And I would have patiently waited for the price to close above the cloud to add the remaining part of my position in order to comply with cloud breakout strategy. In short you can combine cloud breakout and moving average cross over to detect an ichimoku trading signal which has higher probability of success.

Coming back to the Ultratech cement chart what a dream run this stock has had from the closing of 4349 on that day (8th august’2020) to 5591 till present (8th January 2021) which is significant rise of 28.5%. Generally,

“The steeper or sharper the crossover, stronger the trend”

The above chart of Ultratech cement is a perfect example of the same.

Moving average crossover strategy of ichimoku cloud can be applied by taking an entry when crossover happens. If the trade goes in your favour i.e. when the trend is formed just keep riding the trend by trailing your stop loss Up. Within a few days your stop loss will be above your buying price which means you are at zero risk of loss in this trade. While trailing the stop loss up you can also book some part of the profit as the stock makes new highs and faces any strong resistance. Remember your goal should be to make profit irrespective of what strategy you follow.

As you grow from a beginner to advanced swing trader you can combine moving averages crossover strategy with “adding to winners” or “pyramiding” strategies which are perfectly suited for the trend following system provided by ichimoku kinko hyo technical indicator.

You can learn ichimoku cloud breakout strategy through recent chart examples of April 2024 by watching my video on the same:

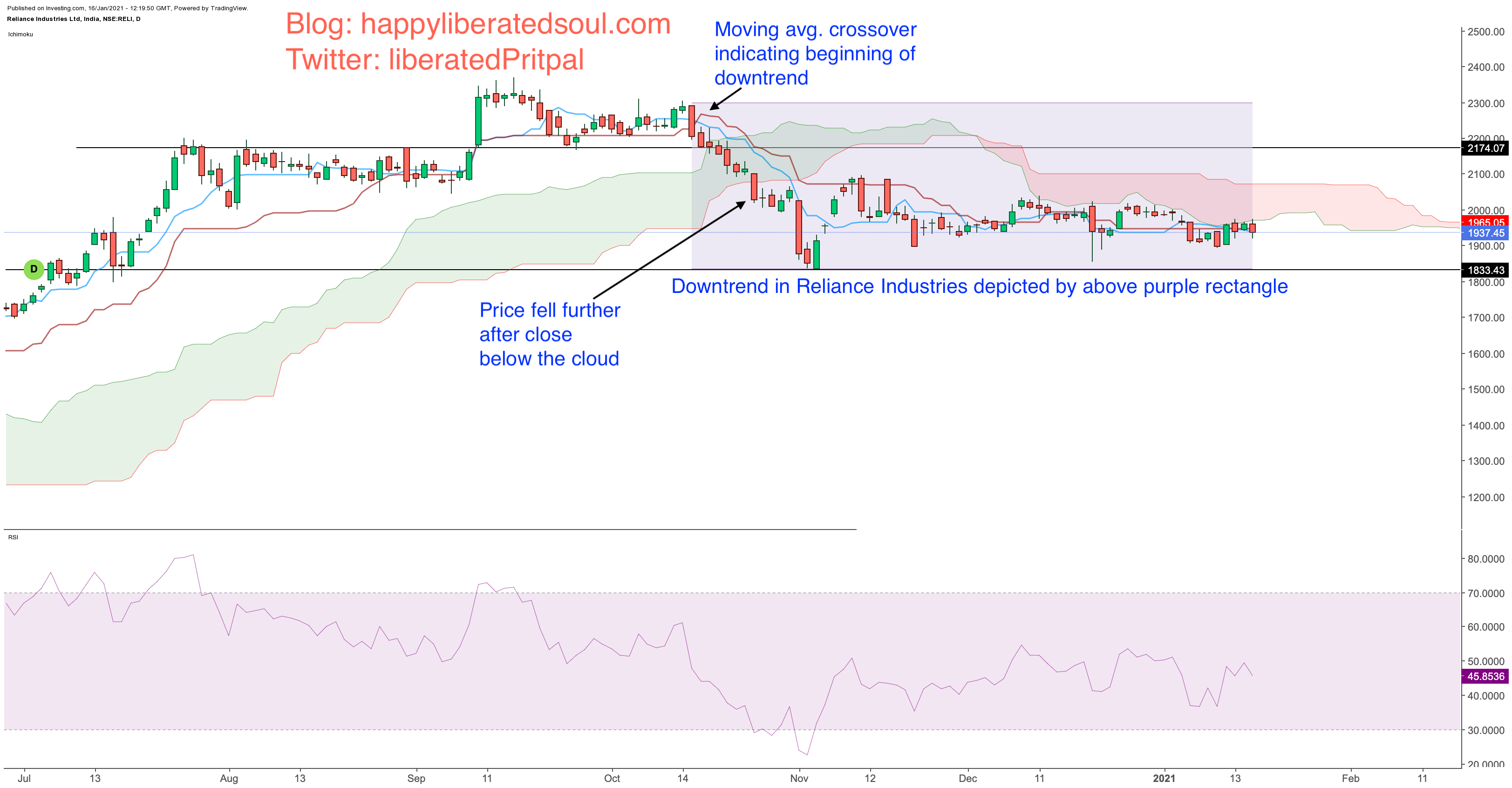

Bearish crossover strategy

The opposite of the above is also known as moving averages crossover i.e. when the base line crosses the conversion line from down to up it indicates the beginning of a downtrend. With conversion line being the short term trend indicator most swing traders focus on it therefore this can also be viewed as the conversion line crossing the base line from up to down.

In this case you can use moving average crossover strategy to go short on the stock in question. It is also known as the Tenkan Sen/Kijun Sen cross strategy, TK cross strategy , bearish crossover strategy or death crossover.

For eg. look at a bearish moving average crossover on Reliance Industries chart below, on a daily timeframe, with conversion line sharply crossing the baseline from top to bottom on 16th October 2020 as highlighted at the beginning of the rectangle with purple shade. The candle closed at a price of 2174 on that day. Thereafter the price consistently kept falling with the series of lower highs and lower lows confirming the downtrend in reliance industries.

Eventually after a few days price closed even below the cloud with a thick red candle thereby giving a short or a sell signal on the basis of ichimoku cloud breakdown strategy, as highlighted by the arrow in the chart.

You can learn Ichimoku cloud’s bullish crossver strategy on recent chart examples of April 2024 as well by watching my video on the same:

Price went as low as 1833.43 which means a significant fall of 15% within 12 trading days in the stock which has the highest share in 50 stocks of Nifty50. This goes to show you how powerful the trading signal given by ichimoku clouds trading strategies can be such that even the might of the largest stock of Nifty cannot defy it. Since then the price tried to move up but it has failed to close even inside the cloud forget about closing above the cloud as highlighted by the entire rectangle with a purple shade. This means that reliance industry is still in downtrend.

Chikou Span: The most Powerful line of Ichimoku Indicator

Any tutorial about ichimoku cannot be complete without covering the importance of Chikou Span or the lagging span i.e. the dark green line in the charts. As explained above it is nothing but today’s price plotted 26 days ago. Chikou span also plays a significant role in finding out whether the stock in question is in uptrend or downtrend.

If chikou span is above the 26 days ago price or candle it indicates currently the stock is in uptrend. Conversely if the chikou span is below the 26 days ago price or candle it indicates currently the price is in downtrend.

Similarly if the chikou span is above the 26 days ago cloud it indicates currently the stock is in uptrend. Conversely if the chikou span is below the 26 days ago cloud it indicates currently the price is in downtrend.

To add to it chikou span gives a good indication about the support and resistance for today. The position of candle sticks, clouds and the moving averages i.e. conversion & base lines acts as level of S & R (support and resistance) for Chikou span. The S & R for the chikou span gives a good suggestion as to what is the possible S & R for the stock price today. Let me show this with the help of a chart.

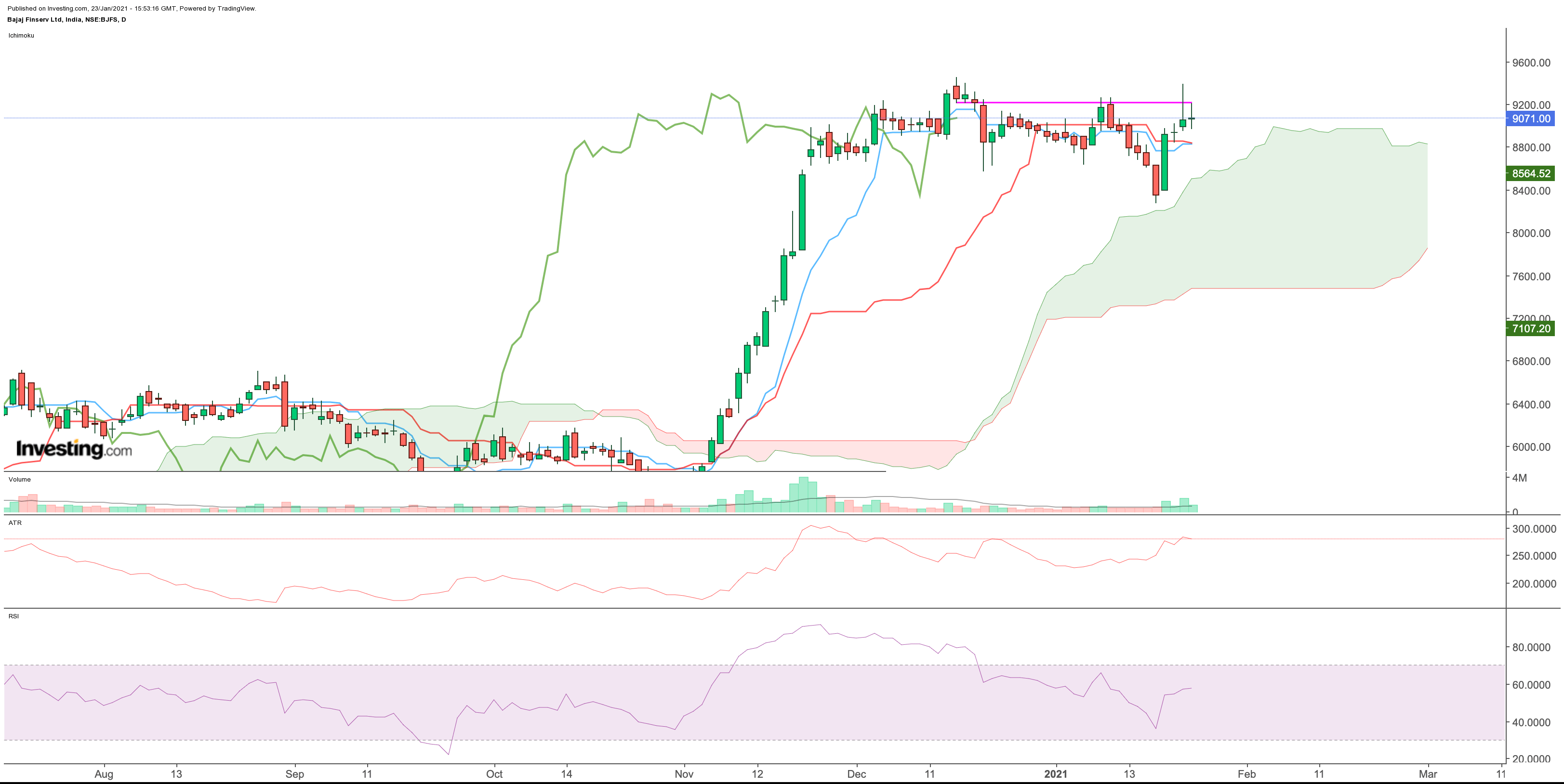

In the below chart of Bajaj Finserv Ltd. on daily timeframe, 26 days ago price candle which made a low of 9216 acted as resistance for Chikou span and the same point acted as resistance for the current day price candle as well, as highlighted by the pink line on the chart. A trader could have booked his profit at 9216 if he was using ichimoku cloud indicator by placing a target order based on chikou resistance.

Therefore a good way to capitalize on this feature is to note down all possible levels of support and resistance based on chikou span in the morning itself and add your target and stop loss orders accordingly. Many Japanese technical analysts consider Chikou Span as the most powerful of all the lines and spans that constitute the Ichimoku Kinko Hyo technical indicator.

Conclusion

Well this has been one of the most comprehensive articles I have written on this blog and the first article under the Money category. Needless to say it was a laborious task and took me few weeks to complete it but at the end i am completely satisfied with how it turned out to be. I hope the readers will feel the same after reading it more because I have added charts of stocks wherever required to clearly explain each and every aspect of ichimoko. Let me summaries what i have covered in this ichimoku tutorial:

- Ichimoku cloud does not work in all market conditions

- Ichimoku is not as complex as it looks from its structure.

- Ichimoku kinko hyo works only when the stock is in clear uptrend or downtrend

- Ichmoku works only in a longer timeframe of 1 hour or more.

- Ichimoku cloud is not just an indicator but its a complete package in itself. It can let a trader detected if the stock is in uptrend, downtrend or is trading sideways.

- Moving average crossover is a reliable Ichimoku trading strategy which can be used to long or short a stock depending on the direction of tenkan sen.

- Chikou span is one of the most powerful components of ichmoku indicator and can be used to find out the support and resistance for current timeframe.

What has your experience been while trading in general and trading using ichimoku technical indicator in particular. Feel free to share your experience in comment box, I am more the happy to hear from you and more than willing to answer your queries related to ichimoku clouds.

Very nice post. I just stumbled upon your blog and wanted to say

that I’ve truly enjoyed surfing around your blog posts.

In any case I will be subscribing to your feed and

I hope you write again very soon!

Thanks Dominique for subscribing to feed of my Happiness blog

Hello to every one, since I am genuinely

keen of reading this website’s post to be updated regularly.

It carries nice data.

Thanks Geoffrey

I am glad to know that someone if keen to read my Happiness blog

Be Happy

Way cool! Some very valid points! I appreciate you

penning this post and the rest of the website is also

really good.

Hi Henson, thanks for your token of appreciation about my blog post on how to use ichimioku cloud technical indicator

Hello there! Would you mind if I share your blog with my twitter group?

There’s a lot of people that I think would really

appreciate your content. Please let me know. Thanks!

Thanks Shawna for appreciating my content,

And yes you can surely share my blog on Ichimoku cloud trading strategy in your twitter group.

Wow, this article is nice, my sister is analyzing such

things, so I am going to inform her.

Thanks a lot Sam i am glad to know that you found my tutorial on how to use ichimoku cloud indicator useful and i hope you sister will also find it handy while doing her analysis.

I have found very interesting your article. It’s pretty worth enough for me.

In my view, if all website owners and bloggers made good content as you did,

the web will be a lot more useful than ever before.

Thanks Elisa,

I am glad that you found my article interesting, happy trading.

Thanks for sharing your thoughts. I really appreciate your

efforts and I am waiting for your further write ups

thanks once again.

Thanks Dani for appreciating my efforts to write on ichimoku clouds trading strategies, it means a lot to me.

Thank you for your help and this post. It’s been great.